As a financial advisor, it’s important to understand what clients value most when working with a professional.

That’s why a recent study conducted by Morningstar provides valuable insights into what clients prioritize when seeking financial advice, and where advisors may have opportunities to better meet their clients’ needs.

The study surveyed two groups: financial professionals and individuals. The financial professional sample consisted of 253 professionals drawn from Morningstar’s communications database, 161 of which were financial advisers who worked directly with individual investors. The sample of individuals consisted of a nationally representative sample (n = 1,066) of non-retired Americans of whom were investors who owned either a 401(k), 403(b), thrift savings plan, IRA, Keogh, SEP, or investments such as mutual funds, money market accounts, stocks, certificates of deposit, or annuities.

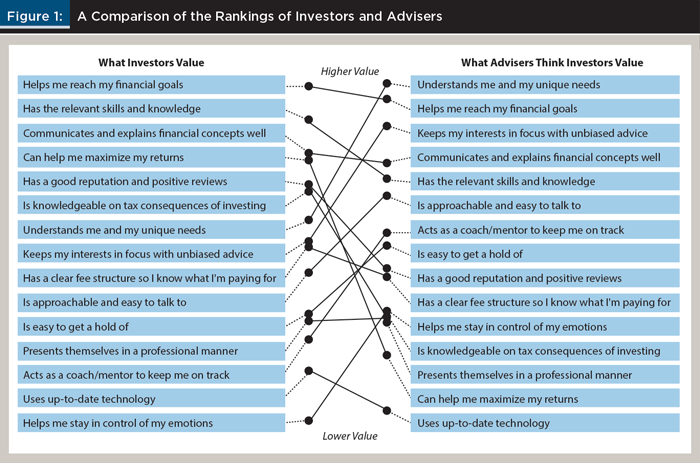

Investors were asked to rank a broad set of attributes in order of importance when working with a financial advisor.

The sample of advisers were also asked to rank the same list of attributes in order of importance from an investor’s perspective.

The study found that there was a moderate positive relationship between the two sets of rankings on average, with a correlation coefficient of approximately +0.46. However, there were some disagreements on what was considered valuable, suggesting opportunities for advisors to better address investors’ needs. The differences in rankings also highlighted some areas where individual investors may be misunderstanding the value of professional financial advice.

Figure 1 displays the average rankings of both investors and advisers. The placement of each attribute represents its average ranking for each group, with the top of the figure showing the highest rated attribute in terms of its importance. For example, in the investor sample, the attribute “Helps me stay in control of my emotions” was rated as the least valuable attribute, as evident from its last place position in the ranking and its substantial distance from the other attributes.

Courtesy of https://www.financialplanningassociation.org/

While some discrepancies in rankings may be harder to address, there are a few attributes that show manageable gaps that advisors can address. For example, investors ranked “Is knowledgeable on tax consequences of investing” much higher than advisors anticipated. Many advisors incorporate tax strategies in their investing process, and this finding may encourage them to include/invite their clients in those decisions and highlight this valuable service. Investors also rated “Has a good reputation and positive reviews” attribute a bit higher than anticipated from advisors. This result may be a useful reminder to advisors of the enduring value of professional reputation.

However, the study also revealed that investors may be undervaluing certain interpersonal services that advisors offer. For example, investors tended to prioritize investment returns, while undervaluing the importance of emotional support and guidance in achieving their financial goals. Advisors should recognize the importance of building a strong relationship with their clients, helping them navigate their emotions during difficult financial times, and providing guidance that helps them stay on track to meet their goals.

This study offers valuable insights into what investors value most when working with financial advisors. Advisors can use this information to better understand their clients’ needs, identify areas for improvement, and ensure that they are offering the most valuable services to their clients.