In today’s dynamic financial landscape, retaining clients and meeting their evolving needs has become increasingly challenging for financial advisors.

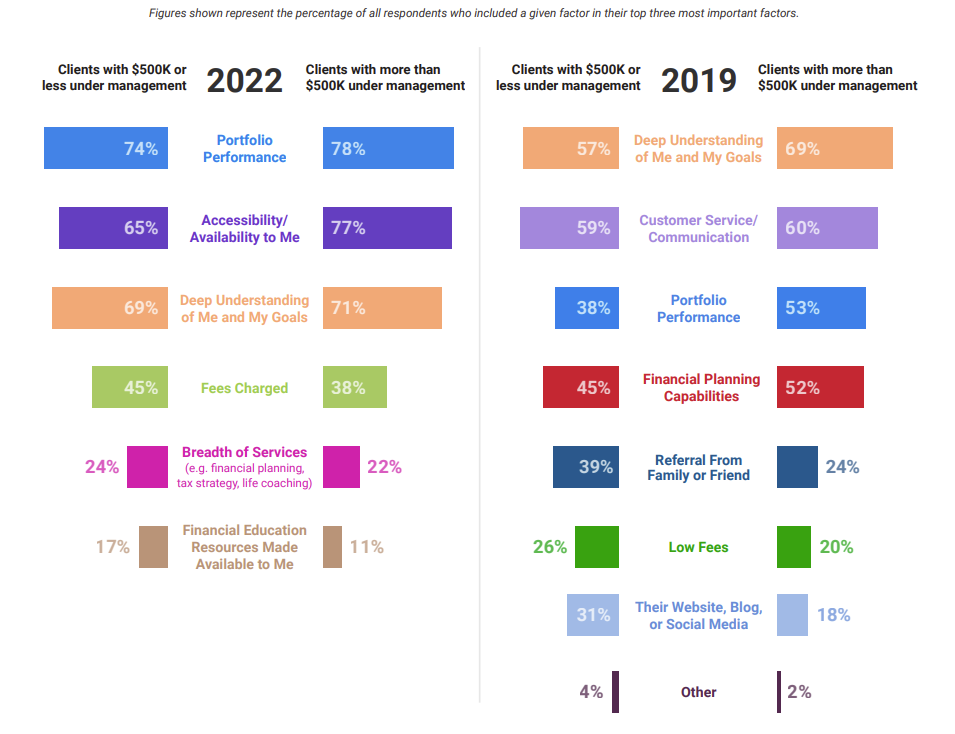

According to a recent survey, portfolio performance has emerged as the top concern for clients when selecting an advisor, with a significant proportion considering switching.

The survey, courtesy of YCharts, found that one in four clients has either switched or considered switching financial advisors within the past three years, with portfolio performance being their primary concern. The COVID-19 pandemic has led to a significant increase in virtual meetings, resulting in clients and advisors discussing portfolio performance more frequently. This increased communication has caused some clients to consider alternatives due to feeling inadequate in their performance.

The survey shows that clients have shifted their area of concern, with portfolio performance now ranking as a top priority when selecting a financial advisor. Clients have also shown the ability to choose advisors based on accessibility or availability and deep understanding of their goals. Market volatility, including significant selloffs in the bond market, has led clients to question traditional risk mitigation strategies and the trust they have in advisors. Increased inflation concerns have also contributed to clients’ heightened focus on their investment performance.

Courtesy of YCharts 2022 Study

Although virtual meetings via platforms like Zoom have gained traction due to their convenience and the expanded reach they offer advisors, clients are increasingly favoring email as 73% of respondents cited email as their preferred mode of communication. Generational differences are evident in communication preferences, with older and retired clients embracing text messages and Zoom meetings, while millennials tend to favor email and have more difficulty expanding to new methods of communication.

Some clients have turned to robo-advisors as an alternative due to their sensitivity towards fees, especially during market downturns. These robo-advisors are allowing clients to reduce their investment management costs due to the lower fees. The study shows the importance of frequent and direct communication, addressing the root of clients’ concerns, and demonstrating value beyond portfolio performance and fees to maintain client satisfaction.

Market fluctuations after the pandemic have accelerated clients’ exploration of new financial advisors, with a significant proportion considering or making the switch. Advisors must adapt their communication strategies, enhance portfolio performance, and address fee-related concerns to ensure client retention and satisfaction.

At Oak and Stone, our advisor services offer the solutions advisors need to enhance portfolio performance, adapt communication strategies, and address fee-related concerns effectively.

Discover how our comprehensive suite of tools and support can help advisors thrive in an ever-changing market.